For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

All of our content is based on objective analysis, and the opinions are our own. Fixed assets lose value throughout their useful life—every minute, every hour, and every day. It would, however, be impractical (and of no great benefit) to calculate and re-calculate the extent of this loss over short periods (e.g., every month). It is in this sense that depreciation is considered a normal business expense and, consequently, treated in the books of account in more or less the same way as any other expense.

What is your current financial priority?

The result is the depreciable basis or the amount that can be depreciated. To start, a company must know an asset’s cost, useful life, and salvage value. Then, it can calculate depreciation using a method suited to its accounting needs, asset type, asset lifespan, or the number of units produced. The units of production method assigns an equal expense rate to each unit produced. It’s most useful where an asset’s value lies in the number of units it produces or in how much it’s used, rather than in its lifespan. The formula determines the expense for the accounting period multiplied by the number of units produced.

What happens if you don’t depreciate?

When your business purchases a big-ticket item such as a vehicle, a building, or equipment, you won’t be able to expense it immediately. Depreciation is how an asset’s book value is “used up” as it helps to generate revenue. In the case of the semi-trailer, such uses could be delivering goods to customers or transporting goods between warehouses and the manufacturing facility or retail outlets. All of these uses contribute to the revenue those goods generate when they are sold, so it makes sense that the trailer’s value is charged a bit at a time against that revenue.

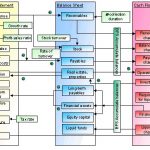

It is the depreciable cost that is systematically allocated to expense during the asset’s useful life. The balance in the 3 ways to build assets Equipment account will be reported on the company’s balance sheet under the asset heading property, plant and equipment. Software makes it easy to track and calculate the depreciation of your small business assets. Track your mileage for vehicles with the mileage tracking app, organize your assets to measure depreciation, and make tax season a breeze with automated financial report generation. A fixed asset such as software or a database might only be usable to your business for a certain period of time. If you use a vehicle or piece of equipment exclusively for business, you can claim depreciation on that asset.

Accumulated Depreciation

- Depreciation is necessary for measuring a company’s net income in each accounting period.

- Salvage value is what a company expects to receive in exchange for the asset at the end of its useful life.

- Companies have several options for depreciating the value of assets over time, in accordance with GAAP.

- Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington.

- We’ll also take a look at how depreciation relates to taxation and accounting, what assets you can claim for depreciation, and common causes of asset depreciation.

The sum-of-the-years’ digits (SYD) method also allows for accelerated depreciation. Determining monthly depreciation for an asset depends on the asset’s useful life, as well as which depreciation method you use. For assets purchased in the middle of the year, the annual depreciation expense is divided by the number of months in that year since the purchase. Depreciation can be one of the more confusing components of the accounting cycle. Used to properly allocate the cost of a fixed or tangible asset, depreciation is not really covered in basic accounting, but it’s something that every small business bookkeeper needs to understand. The cost of the asset minus its residual value is called the depreciable cost of the asset.

Others say that the truck’s cost is being matched to the periods in which the truck is being used up. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, cost driver definition brokers, and investors. She supports small businesses in growing to their first six figures and beyond.

However, if the asset is expected not to have residual value, the full cost of the asset is depreciated. Thus, the cost of the asset is charged as an expense to the periods that benefit from the use of the asset. The part of the cost that is charged to accrued expense operation during an accounting period is known as depreciation. Capital assets such as buildings, machinery, and equipment are useful to a company for a limited number of years. The entire cost of a capital asset is not charged to any one year as an expense; rather the cost is spread over the useful life of the asset. The asset’s cost minus its estimated salvage value is known as the asset’s depreciable cost.