While both methods have their advantages and disadvantages, it’s important to choose one that suits your business needs. On the other hand, debiting your inventory can provide a more accurate picture of COGS by reducing its overall value as sales occur. In this way, debits essentially act like expenses against revenue and give a more realistic inventory debit or credit view of profitability over time. If you have high sales volume but low product turnover rates, using FIFO (first-in-first-out) might be best for tracking costs accurately. The last entry in the table below shows a bookkeeping journal entry to record the inventory as it leaves work-in-process and moves to finished goods, ready for sale.

Document your process

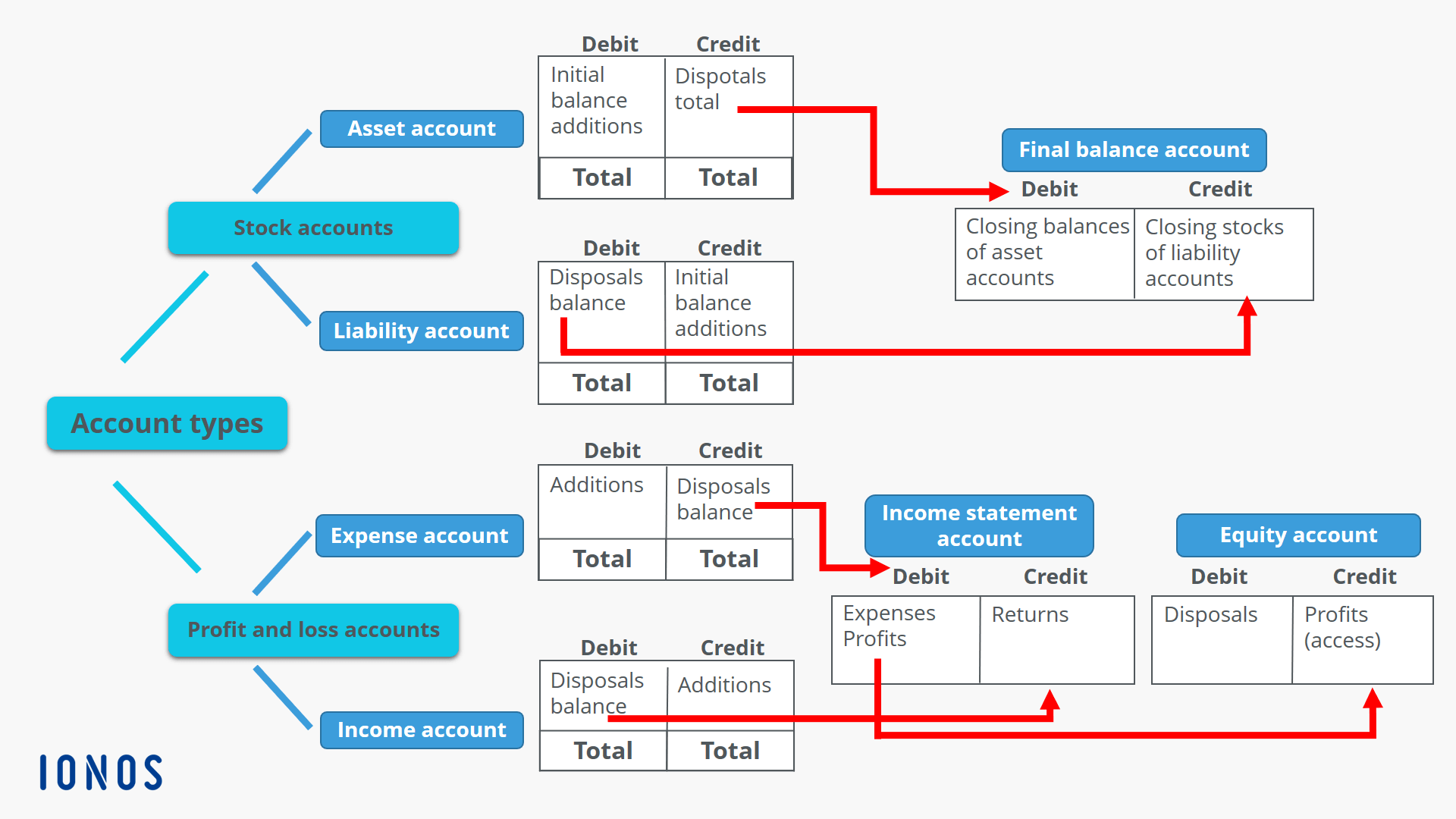

In general, assets increase with debits, whereas liabilities and equity increase with credits. When selling inventory to a non-Cornell entity or individual for cash/check, record it on your operating account with a credit (C) to sales tax and external income and debit (D) to cash. When selling inventory and recording an accounts receivable, use an accounts receivable object code. Now, you see that the number of debit and credit entries is different.

Totals Must Match

To accurately calculate and record the valued inventory each year, businesses must select one of these costing methods and apply it consistently. The periodic inventory system tracks inventory by periodically checking the inventory using a physical count to measure the stock and cost of goods sold. Accounting and inventory, while both critical components of any business, may seem like two separate tasks, but they are very much linked. Calculating your inventory, or inventory accounting, is a key part of a business’s success. Inventory management involves tracking the flow of goods from procurement to delivery, ensuring that there’s always enough on hand when needed.

Advantages of Inventory Accounting

In a modern, computerized inventory tracking system, the system generates most of these transactions for you, so the precise nature of the journal entries is not necessarily visible. Nonetheless, you may find a need for some of the following entries from time to time, to be created as manual journal entries in the accounting system. Assets and expense accounts are increased with a debit and decreased with a credit. Meanwhile, liabilities, revenue, and equity are decreased with debit and increased with credit.

Keeping the formula in balance

Inventory does not count directly as income on a person’s income statement. In accounting, the terms credit and debit are used to describe the two sides of a transaction. Understanding the difference between these two concepts is crucial for managing your business’s finances effectively. This represents insurance premiums paid in advance, which will be expensed over time.

How to Determine Which is Best for Your Business

Label and store inventory in a manner that allows you to easily access items and determine the quantity on-hand. Separate and note obsolete or damaged products and record waste or damaged products on a waste sheet. Limit access to inventory supply and implement procedures for receiving and shipping. Ensure that all employees responsible for inventory control and accounting entries are knowledgeable about the products and items inventoried. The total of your debit entries should always equal the total of your credit entries on a trial balance.

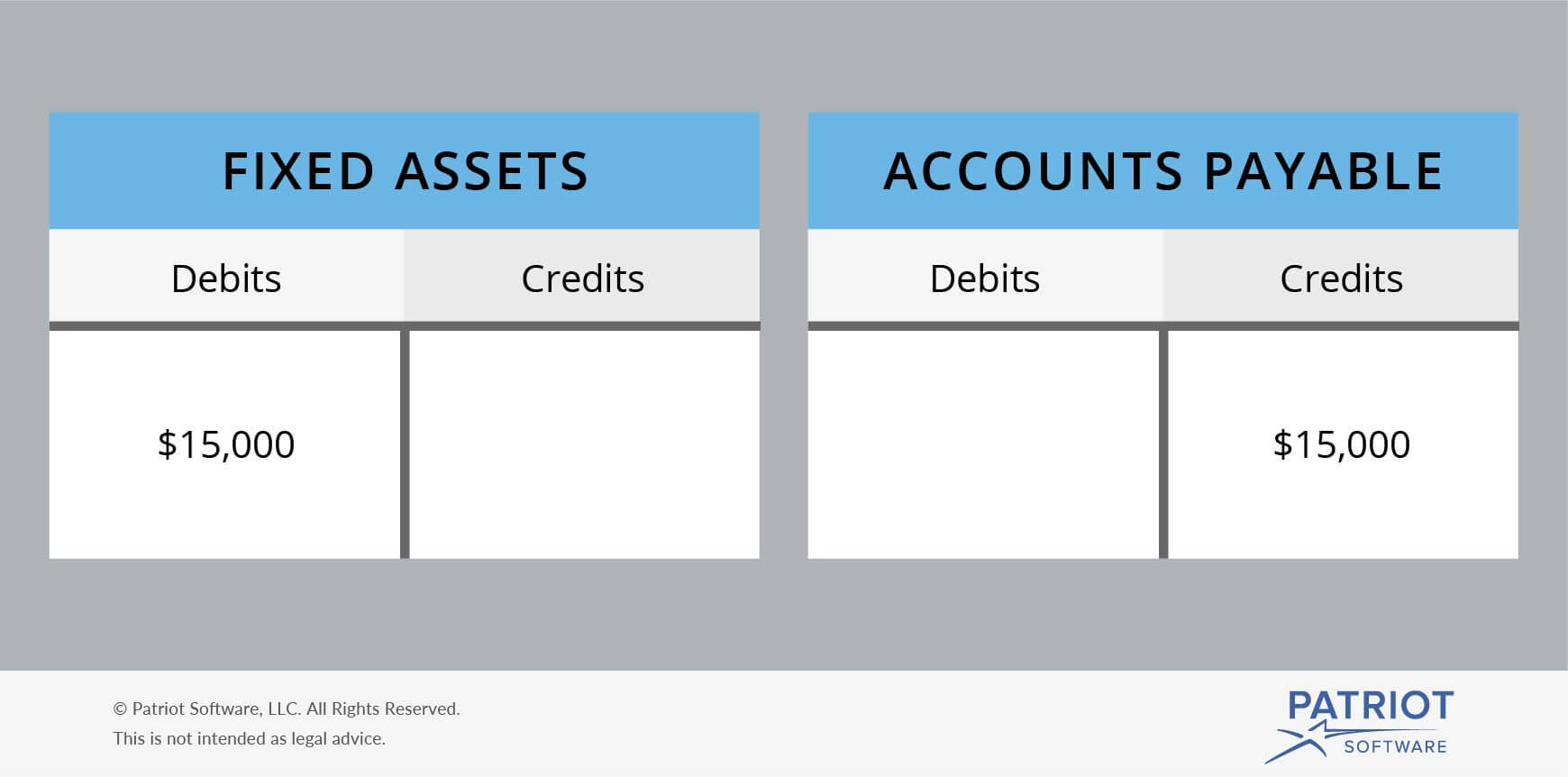

Debits and credits are used in a company’s bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. When recording a transaction, every debit entry must have a corresponding credit entry for the same dollar amount, or vice-versa.

It means that something has been added to an account or money has been taken out from another account. For example, if a company purchases inventory for $5,000, it will be recorded as a debit in the inventory account since it is considered an asset. The perpetual inventory system records and tracks inventory balances continuously. Updates are made automatically to this system, tracking when products come in and out of the inventory account.

- In this guide, we’ll provide an in-depth explanation of debits and credits and teach you how to use both to keep your books balanced.

- When an item is ready to be sold, transfer it from Finished Goods Inventory to Cost of Goods Sold to shift it from inventory to expenses.

- Meanwhile, liabilities, revenue, and equity are decreased with debit and increased with credit.

- For example, if you pay $500 cash for your monthly rent, you’d debit rent expense (the expense increases) by $500 and credit cash (the asset decreases) by $500.

While they may seem straightforward, using them without mistakes is critical to maintaining financial health. At their core, debits and credits are the 2 sides of every financial transaction recorded in the accounting system. Demystify accounting fundamentals with this comprehensive guide to debits and credits, their roles in transactions, and double-entry bookkeeping.

Often, a separate inventory account for returned goods is used — apart from the regular inventory. Inventory is an asset and it is recorded on the university’s balance sheet. Inventory can be any physical property, merchandise, or other sales items that are held for resale, to be sold at a future date. Departments receiving revenue (internal and/or external) for selling products to customers are required to record inventory.

The type of accounting method you use will depend on the size and complexity of your business. It’s important to note that every transaction must have at least one debit and one credit entry. The total amount of debits must always equal the total amount of credits; this principle is known as double-entry bookkeeping. Assets are items that provide future economic benefits to a company, such as cash, accounts receivable, inventory, and equipment. Take a look at the inventory journal entries you need to make when manufacturing a product using the inventory you purchased. Make it a habit to reconcile your accounts with your bank statements regularly — whether that’s weekly or monthly.